Bitcoin Proof of Reserves on Binance

When contrasted to on-chain statistics, CryptoQuant claims that Binance's freshly released Proof-of-Reserves report "makes sense."

Binance's Proof-of-Reserves Report on Bitcoin Liabilities Is Consistent With On-Chain Data

The public evidence that an exchange has properly collateralized the entirety of its clients' deposits is referred to as the Proof-of-Reserves (PoR) in this context. Investors in the cryptocurrency market have grown more skeptical of centralized platforms after the collapse of FTX, and they have been clamoring for exchanges to issue PoR reports.

The largest exchange by trading volume, Binance, recently made public the results of its PoR audit report by Mazars. However, for a number of reasons, some analysts questioned the report. One of the main complaints was that the crypto exchange had the external auditor perform the PoR calculations in accordance with the platform's specifications.

In order to determine whether the data made public by the exchange is accurate and consistent with on-chain data, the analytics company CryptoQuant has now published its own examination of the Binance PoR report. The report states that as of November 22, 2022, 97% of Binance's Bitcoin liabilities—the sum that its consumers had deposited—were collateralized.

The level of collateralization increases to 101% if the platform's loans to users aren't counted as liabilities.

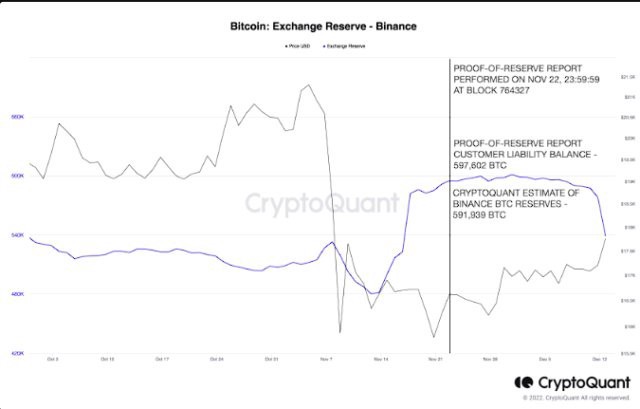

According to the report, the platform's consumer liabilities balance on November 22, 2022, was 597,602 BTC. Here is a graph comparing this to the Bitcoin exchange reserve of Binance as determined by CryptoQuant:

Reserve on the Binance Bitcoin Exchange

Binance's estimated BTC reserves according to CryptoQuant | Source: CryptoQuant

As a result of clustering BTC movements from user wallets to Binance's exchange wallets, the analytics company says its estimate of Binance's BTC reserves is an estimate of the exchange's liabilities.

As seen in the graph, on-chain data estimated the crypto exchange's reserves at 591,939 BTC at the time of measurement, which is 99% of the report's stated value. This suggests that the findings of the PoR study and CryptoQuant's analysis are consistent.

The analytics firm also pointed out that Binance's reserves at this time do not exhibit any of the unusual behavior seen on FTX previous to its collapse. In contrast to FTX, which had a sizable amount of its capital in its FTT coin, BNB accounts for only slightly more than 10% of the exchange's assets.

CryptoQuant warns that "our analysis should not be construed as a positive judgment of Binance as a company, the ecology of the BSC/BNB networks, or the BNB token." It is merely a sign that on-chain data supports the amount of BTC that Binance exchange claims to possess as liabilities at the time the PoR report was conducted.

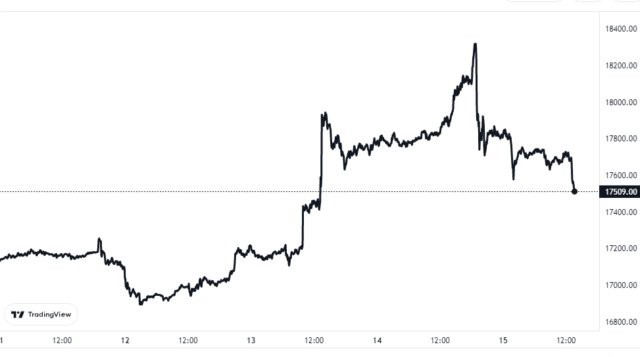

Price chart for bitcoin

BTC appears to be declining | BTCUSD as a source on TradingView

As of this writing, the price of Bitcoin is around $17,500, up 4% over the previous week.

0 comments

Be the first to comment!

This post is waiting for your feedback.

Share your thoughts and join the conversation.