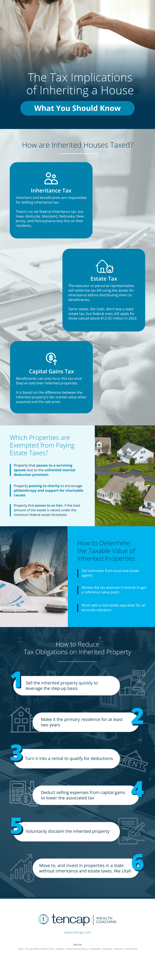

The Tax Implications of Inheriting a House: What You Should Know

Inheriting a house is not only a significant life event but also a financial responsibility loaded with tax implications.

Whether in estate planning or inheriting property, a proactive stance guarantees informed decisions that protect your financial interests. However, before fighting for your inheritance, you must first understand these tax intricacies for seamless asset transition and strategic financial planning.

How to Determine the Taxable Value of Inherited Properties

Identifying the taxable value of inherited property is crucial for understanding its financial implications, especially if your beneficiaries plan to sell it.

1. Seek estimates from real estate agents:

Real estate agents offer valuable insights into local market dynamics, providing Comparative Market Analysis (CMA) reports. These analyses consider recent sales, market conditions, and property specifics, aiding in tax calculations, particularly for capital gains. Obtaining estimates from multiple agents ensures a comprehensive valuation.

2. Review tax assessor records

Tax assessors maintain property value records, typically based on size, location, and features. While these assessments provide a baseline, they may not always reflect current market value. Supplementing with alternative valuation methods is advisable.

3. Engage a real estate appraiser

A licensed real estate appraiser offers precise and impartial property valuations. Collaborating with one ensures a comprehensive appraisal report, particularly beneficial for complex or unique properties like historical landmarks or specialized commercial estates. Their expertise aids in accurately determining taxable value, which is vital for informed financial decisions.

3 Ways to Reduce Tax Obligations on Inherited Property

Tax obligations are among the few things in life that are always certain, but that doesn’t mean you can’t do anything about it. Below are a few ways you can minimize the amount you spend for tax on your inherited property.

1. Leverage the step-up basis

Upon inheritance, the tax basis of a property adjusts to its fair market value. Selling the property promptly after inheritance can capitalize on this adjustment, potentially minimizing capital gains tax.

2. Designate as a primary residence

Transforming the inherited property into a primary residence can unlock tax benefits. The Taxpayer Relief Act of 1997 permits you to exclude a portion of your capital gains from taxation upon selling the primary residence.

3. Convert to rental property

Alternatively, converting the inherited property into a rental asset can yield tax advantages. Rental income allows for deductions on various expenses, helping to mitigate tax liability while retaining ownership.

Navigate Real Estate Inheritance Taxes with Precision

Inheritance is often more complicated than most people realize. Professional guidance and an understanding of the fundamentals of property inheritance tax will allow you to navigate through these complexities with fewer headaches.

Being proactive allows you to protect your finances effectively. The infographic below discusses more about it in detail.

Follow Tencap Wealth Coaching to stay updated on their latest posts!

0 comments

Be the first to comment!

This post is waiting for your feedback.

Share your thoughts and join the conversation.