Positive Economic Projections of Extending ATM Access to Remote Rural Areas

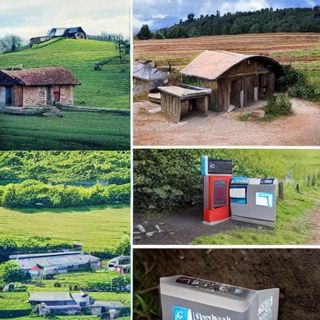

In our rapidly evolving global economy, access to financial services is a fundamental necessity for individuals and businesses alike. The introduction and expansion of Automated Teller Machines (ATMs) have played a pivotal role in enhancing financial inclusion and economic growth in many countries. This essay explores the potential positive economic impact that can be realized when governments extend ATM installation to even the most remote rural areas, focusing on economic empowerment, increased savings, financial literacy, and local entrepreneurship.

I. Economic Empowerment in Rural Areas

1.1 Enhanced Access to Banking ServicesExtending ATM access to remote rural areas empowers individuals by granting them easy access to banking services. In regions where traditional brick-and-mortar banks are scarce or distant, ATMs become essential tools for conducting basic financial transactions. People can withdraw cash, deposit funds, check account balances, and perform other financial activities conveniently, thus reducing the financial exclusion gap.

1.2 Increased Financial InclusionFinancial inclusion is a key driver of economic development. By making banking services more accessible, particularly to unbanked or underbanked populations, ATMs can help more people participate in the formal economy. This fosters savings, investments, and access to credit, all of which contribute to overall economic well-being.

II. Increased Savings and Investment

2.1 Savings MobilizationThe presence of ATMs in remote rural areas encourages people to save money. When individuals have access to ATMs, they are more likely to deposit their earnings in bank accounts, as the fear of holding large sums of cash diminishes. Increased savings not only safeguard personal finances but also stimulate economic growth by making funds available for investment.

2.2 Investment OpportunitiesRural entrepreneurs can benefit significantly from increased savings. As people save more, banks have access to a larger pool of funds that they can lend to businesses, which, in turn, can lead to business expansion and job creation. Access to formal banking also enables individuals to explore investment opportunities such as starting small businesses or investing in education, both of which can contribute to economic growth.

III. Financial Literacy and Education

3.1 Improved Financial LiteracyThe introduction of ATMs in remote rural areas can be accompanied by financial education initiatives. This combination of access and education can significantly improve financial literacy among the local population. People can learn about budgeting, savings, investment, and managing debt effectively, leading to more responsible financial behavior.

3.2 Empowering Decision-MakingFinancially literate individuals are better equipped to make informed financial decisions. They can choose suitable financial products and services, which can include insurance, loans, and investment options. In the long run, this promotes economic stability and resilience, reducing the risk of financial crises.

IV. Local Entrepreneurship

4.1 Access to CapitalOne of the primary challenges faced by rural entrepreneurs is limited access to capital. ATMs can bridge this gap by enabling rural business owners to access their funds easily and seek loans or credit when needed. This access to capital can fuel the growth of local businesses, create jobs, and contribute to the economic vibrancy of rural areas.

4.2 Encouraging EntrepreneurshipATMs can also encourage entrepreneurship by simplifying financial transactions for small businesses. With access to electronic payments and the ability to receive payments from customers, rural entrepreneurs can expand their customer base and improve their business operations. This can lead to the establishment of new businesses and the diversification of local economies.

V. Infrastructure Development

5.1 Infrastructure InvestmentThe installation of ATMs in rural areas requires the development of necessary infrastructure, including power supply and network connectivity. This infrastructure investment not only supports the ATM network but also benefits the community by improving overall infrastructure quality. Better roads, electricity supply, and telecommunications infrastructure can have a positive ripple effect on economic activities in the region.

5.2 Job CreationThe deployment and maintenance of ATMs in rural areas create job opportunities. Local technicians are needed for ATM installation, maintenance, and repair. This boosts local employment and can lead to the development of new skills and job opportunities, particularly for the youth in rural communities.

Conclusion

Extending ATM access to remote rural areas holds the potential to bring about substantial positive economic changes. By promoting economic empowerment, increasing savings and investments, fostering financial literacy, encouraging entrepreneurship, and driving infrastructure development, this initiative can significantly contribute to the economic growth and well-being of rural communities. Governments and financial institutions should collaborate to make this vision a reality, ensuring that even the most remote regions can reap the benefits of modern financial services and contribute to the broader economic prosperity of their nations.

Follow Gabriel Nainggolan to stay updated on their latest posts!

0 comments

Be the first to comment!

This post is waiting for your feedback.

Share your thoughts and join the conversation.